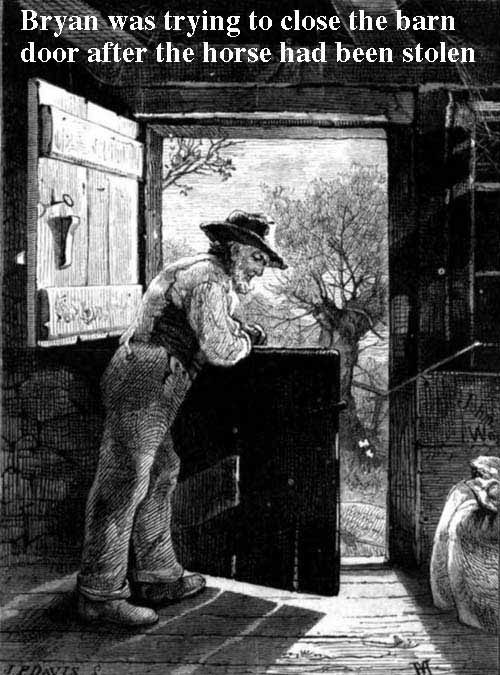

Now that the horses have fled the barn and the barn is on fire there are some attempts to regulate the mortgage origination industry to ensure the borrowers using exotic products know the risks. Yeah, right. For nearly every one of these borrowers all they know is; Sign here -> get a house. Don't sign -> no house. No amount of warning, education, bamboo under the fingernails is going to make these kinds of credit users change. They have to be told "no."

16 comments:

La Premiere!

En second lieu!

On topic now:

http://tinyurl.com/2dojdy

-jbjbj

That old guy looks more like an Abe to me.

And I agree with you. If you leave the option to commit financial suicide up to the grantee then that's what you will get. Lending institutions need to be the grown-ups in these cases.

As with most things in the country, this whole mortgage lending situation has been bass ackwards for a long time.

Leave it to our corrupt politicians who turned a blind eye while they accepted blood money from the NAR & MBA, to start the hearing well AFTER the damage is done.

Make me want to move to a third world country and forget all this nonsense...

...as long as I can get my daily EN fix of course!

Holy shit. We may have another snowflake here in shit up to his eyeballs....$344K in unsecured debt plus another $560K mortgage to service:

http://www.my334442debt.com/

It adds up to a $8317/month in payments. Look at all those 32% credit lines:

http://www.my334442debt.com/images/sins.bmp

He even says "sweet" and "now I can focus on."

He's probably a Casey supporter also.

It's all good though.

Actually I just finished reading his whole blog. Yes, he uses 'sweet' a lot and that made me cringe. But at least this guy appears to be working on his problems. He has cut up his credit cards and called all his lenders to try to reduce rates and get forbearance.

Plus he's quit eating out and started buying cheap food in bulk.

Much better than our original snowflake, but still in a heap of shit.

Not to mention, he's able to put together his own budget and track his expenses without the urging and guidance from the likes of Tim the Ripper.

Snowflake has a new post.

Tim the ripper.

LOL.

Dumbfounded-

The biggest difference between this kid and The Original Snowflake(tm), is that this kid HAS A JOB.

I'm rooting for the new kid. He saw his mistakes, and actually DID SOMETHING ABOUT IT.

Best of luck, 344k!

TNG is in dire straits but at least he's attempting to navigate. Casey just doesn't seem to care. That's what infuriates me about him.

He's really not doing much about it. Compared to Casey, sure.

He'll end up in BK.

The real problem is that too many people trusted the Mortgage Companies too much. Since the Mortgage and people were the "Experts", it was assumed that they could be trusted.

In order to stop this kind of crapola from happing again, laypeople have to do some SERIOUS INDEPENDANT RESEARCH ON THEIR OWN!

1:21 PM, JimBobJoeBobJim

Yeah, he even works 12 hours a day too.

1:43 PM, Anonymous

I agree. In the end he's still probably going BK.

In discussion of homeowner debt, one thing that is rarely brought up is that once using borrowing becomes common in any market, then it becomes necessary for everyone to use sweet leverage to compete, unless you are wealthy enough to be a financial institution.

Do do otherwise is to show up at a gunfight armed only with a knife.

Post a Comment